Friday, March 20th, 2015

by GEORGE BOLLENBACHER

In my last article I reviewed the SEC’s final and proposed rules on transaction reporting by market participants. In this article I will look at the final rule on SDRs, and make some observations on the effectiveness of current and future reporting regimes.

The SEC’s final SDR rule is entitled “Security-Based Swap Data Repository Registration, Duties, and Core Principles” and runs some 468 pages. Don’t worry, you don’t have to read them all, just go to page 424 to find the beginning of the rule text. The bulk of the rule is in §232.13, which itself is divided into 12 subsections:

240.13n-1 Registration of security-based swap data repository.

240.13n-2 Withdrawal from registration; revocation and cancellation.

240.13n-3 Registration of successor to registered security-based swap data repository.

240.13n-4 Duties and core principles of security-based swap data repository.

240.13n-5 Data collection and maintenance.

240.13n-6 Automated systems.

240.13n-7 Recordkeeping of security-based swap data repository.

240.13n-8 Reports to be provided to the Commission.

240.13n-9 Privacy requirements of security-based swap data repository.

240.13n-10 Disclosure requirements of security-based swap data repository.

240.13n-11 Chief compliance officer of security-based swap data repository; compliance reports and financial reports.

240.13n-12 Exemption from requirements governing security-based swap data repositories for certain non-U.S. persons.

The Boring Stuff

As we can see from the list above, the first three sections of the rule pertain to registration as an SDR, or, as the SEC abbreviates it, SBSDR (except that they very seldom abbreviate it). Given that SDRs have been functioning in the US for more than a year, it would be astonishing if the SEC had significantly different registration requirements from the CFTC’s, and it doesn’t. So 13n-1 through 13n-3, 13n-6 through 13n-8, and 13n-11 are pretty much as expected.

Items of Interest

In light of the recognized problems with reporting accuracy, the following wording in 13n-4 bears examination:

(b) Duties. To be registered, and maintain registration, as a security-based swap data repository, a security-based swap data repository shall:

(7) At such time and in such manner as may be directed by the Commission, establish automated systems for monitoring, screening, and analyzing security-based swap data;

13n-5 has similar wording:

(i) Every security-based swap data repository shall establish, maintain, and enforce written policies and procedures reasonably designed for the reporting of complete and accurate transaction data to the security-based swap data repository and shall accept all transaction data that is reported in accordance with such policies and procedures.

So far, none of the regulators have mandated any responsibility on the part of the SDRs to monitor data quality, nor have they laid out any guidelines for doing so. However, there are signs that such monitoring may be in the offing, and this language lays that responsibility squarely on the SBSDR. How extensive the monitoring might be, how the regulators would verify that it was being done, and what the penalties would be for failing in this function aren’t covered here. And, since 13n-4 is the only place in the rule text where the term “monitoring” is used, it isn’t covered anywhere else in the rule or, as it turns out, in the preamble.

The Current State of Affairs

In January, 2014 the CFTC issued a proposed rule called “Review of Swap Data Recordkeeping and Reporting Requirements.” The comment period ended May 27, 2014. I haven’t been able to find any comment letters on this proposal on the CFTC’s web site, nor any final rule on this subject.

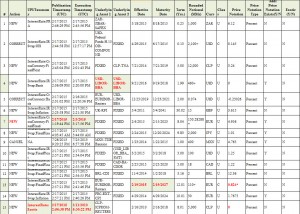

So how accurate is swaps reporting today? I took a look at a snapshot of the most liquid swaps category, rates, from the DTCC SDR site, and posted it below. The questionable items are in red.

Just to help us read the table, the first item is a new uncleared ZAR three-month forward rate agreement beginning 5/18 and ending 8/18. The notional amount appears to be ZAR1,000,000,000 and the rate is 6.12%. With that as background, let’s look at some of the anomalies.

Item 4 is a new two-year USD basis swap beginning 9/21/2016. A basis swap is normally between two different floating rates, but the underlying assets in this transaction appear to be the same (USD-LIBOR-BBA). I’m not sure what a basis swap between the same rate would be, unless it is between two different term rates, like 1-year and 5-year. However, if that’s true the report doesn’t tell us, so we are in the dark as to what this trade really is.

Item 7 is a new 8-year Euro-denominated fixed-fixed above the block threshold (that’s what the plus at the end of the notional means) which appears to have gone unreported for two weeks. There is a delay in reporting block trades, but it isn’t two weeks. One of the monitoring functions the regulators might implement is any trade where the difference between the execution and reporting timestamps is greater than the rule allows.

Item 13 is a new 12-year Euro-denominated fixed-floating swap that appears to be above the block threshold of €110,000,000. What is interesting here is that the 12-year Euro rate at the time was about 0.4%, not 0.824%. If there is no other parameter on this trade, it looks to be significantly off the market, unless there was a large credit risk component.

Item 15 is…what, exactly? It’s a new trade in some exotic that went unreported for 5 days, with no price given, apparently. Since the notional looks like 5,000,000,000 Chilean pesos, or about $8,000,000, perhaps we don’t need to worry too much about what it really is, but exotics of this size denominated in dollars should cause us to ask just what kind of swap was done, and how much risk it entails.

Summing Up

All of the world’s swap regulators recognize that reporting is a mess. For example, here’s an excerpt from ESMA’s annual report: “In order to improve the data quality from different perspectives, ESMA put in place a plan which includes 1) measures to be implemented by the TRs and 2) measures to be implemented by the reporting entities. The first ones were/will be adopted and monitored by ESMA. The second ones are under the responsibility of NCAs. This plan was complemented by regulatory actions related to the on-going provision of guidance on reporting, as well as the elaboration of a proposal for the update of the technical standards on reporting, leveraging on the lessons learnt so far by ESMA and the NCAs.” (emphasis added) However, it is hard to find any mention of such a plan in ESMA’s 2015 work programme.

We might have expected that the SEC, much the latest to the swaps reporting party, would have taken pains to get it right, and perhaps lead the way to a better world. Since some of their rulemaking is still in the proposal stage, we might still see them get it right, but I wouldn’t bet on it.