Author: Fiona Maxwell

Source: Risk magazine | 01 Jul 2014

The DTCC is taking nearly a month to match inter-repository trades, and corporates are concerned that they will shoulder the blame

The Depository Trust & Clearing Corporation (DTCC) is taking nearly a month to match derivatives trade reports sent to different trade repositories – a situation that is worrying corporates, who are concerned about possible regulatory sanctions.

Since February 12, the European Market Infrastructure Regulation has required both counterparties to a derivatives transaction to report the trade to one of the six trade repositories registered with the European Securities and Markets Authority (Esma).

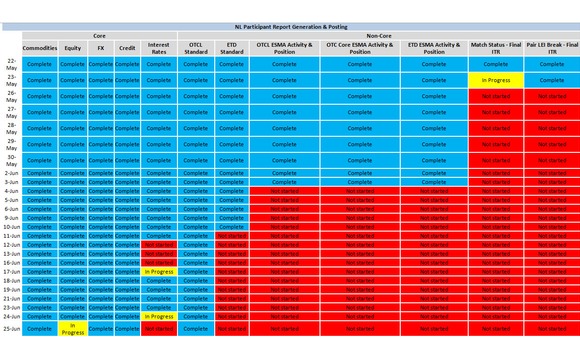

If the counterparties report their trade data to two different repositories, the two halves need to be matched. However a table obtained by Risk reveals that the DTCC is taking nearly a month to match these so-called inter-trade repository reports, leading to concerns from corporates that regulators may place the blame for any missing reports on them, rather than the trade repository.

They’ve improved a lot but still there doesn’t seem to be much reconciliation between repositories

“I’m worried one day the regulators will come to us and say: ‘Why didn’t you report these trades?’ I did, but those trades are not in the DTCC’s systems and I don’t know what they’ve done with them,” says one European corporate treasurer.

The table shows that, as of June 26, the DTCC had not yet started matching trades submitted on May 26. An earlier table dated June 6, also seen by Risk, shows just a two-week backlog of inter-trade repository matching – an indication that the delays are growing.

Industry sources have estimated that the DTCC has around three-quarters of the market share in Europe based on transaction volumes.

Clearing members say that while trade repositories in general have been improving their processing since February, inter-trade repository matching remains a concern.

“They’ve improved a lot but still there doesn’t seem to be much reconciliation between repositories. We believe we’ve ironed out the day-one teething issues but there’s still no total line-of-sight around the trade repositories,” says a senior clearing source at one UK bank.

The DTCC has previously acknowledged the difficulties it has faced matching trades involving other repositories. It blamed the difficulties on the patchy use of unique trade identifiers (UTIs) – tags which both counterparties attach to their report to allow repositories to identify both halves of the trade. In some cases, counterparties are generating their own UTIs for the same trade, making it very difficult for the trade repository to match the two halves of the trade.

Sandy Broderick, chief executive and president of the DTCC’s Deriv/Serv repository, told an industry conference that the widespread absence of UTI tags for trades meant they could only match 30% of over-the-counter derivatives transactions and 3% of listed derivatives transactions that have been sent by market participants to different repositories. This rises to 99.7% if UTIs are in place, he said.

In March, trade repositories Unavista and KDPW also admitted having issues matching trades, citing similar difficulties with missing legal entity identifiers and UTIs.

In an email to clients, the DTCC says it is taking steps to remedy this situation, but as the system takes in around 15 million UTIs each trading day it is processing at capacity, which is causing some reports to fall behind. The email also says it is publishing single asset-class end-of-day reports in a timely fashion, but that there are still delays in creating the end-of-day reports for Esma.

To help solve these issues, the email says the DTCC plans to fine-tune the way data is classified and stored to make data extraction easier. It also plans to verify data earlier in the reporting process, and to streamline its tables, functions and reports processes.

In the DTCC table, the inter-trade repository matching process is listed as a “non-core” activity along with four other actions – all of which show lengthy delays – but it is unclear exactly what the other non-core processes are. The “core” section of the table lists most asset classes as fully complete and up to date, apart from interest rates, which shows some gaps in mid-June. Again, however, it is unclear exactly what this “core” data represents.

The DTCC declined to provide any further detail about the table, citing client confidentiality agreements, while other corporate treasury sources could not shed any extra light on it.

In a written statement to Risk, the DTCC says it is trying to help clients where possible. “We are diligently processing and reporting data for over 90,000 legal entities in the European trade repository,” it says. “On a weekly basis, DTCC’s European trade repository receives between 70 and 80 million data submissions. We are working with our clients to resolve any issues they may be experiencing and are continually looking for ways to enhance our system to help clients effectively and efficiently meet their regulatory obligations.”